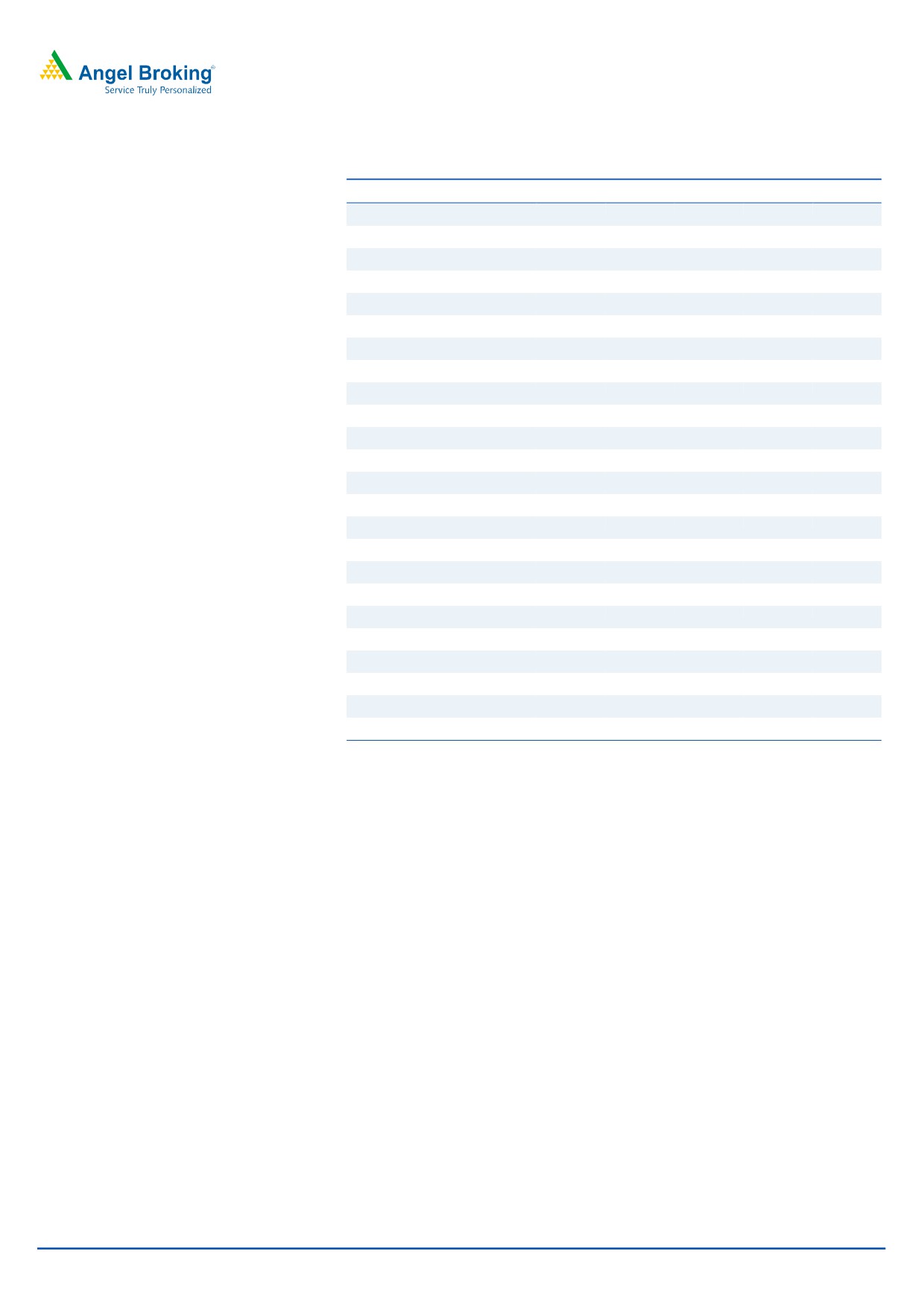

3QFY2016 Result Update | FMCG

May 6, 2016

Procter & Gamble Hygiene & Health Care

BUY

CMP

`6,404

Performance Highlights

Target Price

`7,369

Quarterly Data

Investment Period

12 months

(` cr)

3QFY16

3QFY15

% yoy

2QFY16

% qoq

Revenue

614

555

10.5

714

(14.0)

Stock Info

EBITDA

133

123

8.5

216

(38.3)

Sector

FMCG

Margin (%)

21.7

22.1

(41)

30.3

(857)

Market Cap (` cr)

20,789

Adj. PAT

97

87

12.0

147

(33.7)

Net Debt (` cr)

-619

Source: Company, Angel Research

Beta

0.3

Procter & Gamble Hygiene and Health Care (P&G)’s 3QFY2016 results are

52 Week High / Low

6,981/5,171

broadly in-line with our estimates. For the quarter, the company’s top-line grew

Avg. Daily Volume

4,002

by ~11% yoy to `614cr while the reported PAT grew ~12% yoy to `97cr.

Face Value (`)

10

BSE Sensex

25,262

Key highlights

Nifty

7,736

For 3QFY2016, the company’s top-line grew by ~11% yoy to ~`614cr (against

Reuters Code

PROC.BO

our estimate of ~`624cr), mainly due to growth in both female hygiene and

Bloomberg Code

PG@IN

health care segment. On the operating front, the company reported margin

contraction by 41bp yoy to 21.7%, primarily on account of higher other expenses.

Shareholding Pattern (%)

The reported net profit grew by ~12% yoy to ~`97cr (our estimate was of

Promoters

70.6

~`98cr) on account of healthy sales growth.

MF / Banks / Indian Fls

13.2

FII / NRIs / OCBs

3.8

Outlook and valuation

Indian Public / Others

12.4

On the top-line front, we expect the company to report ~13% CAGR and on the

bottom-line front, we expect ~15% CAGR over FY2015-18E on the back of strong

Abs.(%)

3m

1yr

3yr

brands and distribution network. Further, P&G is a market leader in both of its

Sensex

16.8

(6.4)

28.4

product, ie Whisper (female hygiene segment) and Vicks (healthcare segment-

P&G

2.6

(7.9)

140.1

ointment, creams, cough drops etc). We are positive on the stock and recommend

a Buy rating with a target price of `7,369.

3-year price chart

Key Financials

8000

7000

Y/E June (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

6000

5000

Net Sales

2,051

2,334

2,588

2,939

3,342

4000

3000

% chg

21.6

13.8

10.9

13.6

13.7

2000

Net Profit

302

346

422

474

531

1000

0

% chg

48.7

14.6

22.1

12.2

12.0

OPM (%)

20.5

20.8

23.3

23.2

23.0

EPS (`)

93.0

106.6

130.2

146.2

163.7

Source: Company, Angel Research

P/E (x)

68.8

60.1

49.2

43.8

39.1

P/BV (x)

20.7

16.9

13.6

11.1

9.2

RoE (%)

30.1

28.1

27.6

25.3

23.5

RoCE (%)

38.4

35.2

35.4

32.9

30.9

Amarjeet S Maurya

EV/Sales (x)

10.0

8.6

7.6

6.6

5.7

022-39357800 Ext: 6831

EV/EBITDA (x)

48.8

41.6

32.6

28.5

25.0

Source: Company, Angel Research; Note: CMP as of May 5, 2016

Please refer to important disclosures at the end of this report

1

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Exhibit 1: Quarterly performance

Y/E June (` cr)

3QFY16

3QFY15

% yoy

2QFY16

% qoq

9MFY16

9MFY15

% chg

Net Sales

614

555

10.5

714

(14.0)

1,926

1,776

8.4

Consumption of RM

230

224

3.0

268

(14.2)

728

723

0.7

(% of Sales)

37.5

40.3

37.6

37.8

40.7

Staff Costs

26

38

(29.5)

28

(7.0)

89

93

(5.2)

(% of Sales)

4.3

6.8

4.0

4.6

5.3

Ad. & Marketing Expenses

93.05

92.58

0.5

113.89

(18.3)

259

259

(0.0)

(% of Sales)

15.2

16.7

16.0

13.5

14.6

Operating Expense

130.8

79

87.0

405

371

(% of Sales)

21.3

14.2

12.2

21.0

20.9

Total Expenditure

481

432

11.1

498

(3.4)

1,480

1,446

2.3

Operating Profit

133

123

8.5

216

(38.3)

446

330

35.1

OPM (%)

21.7

22.1

30.3

23.2

18.6

Interest

0

4

(93.7)

2

(89.6)

4

5

Depreciation

12

12

1.7

14

(12.8)

39

39

0.2

Other Income

24

18

33.4

21

14.8

65

56

17.2

PBT

144

125

15.8

220

(34.5)

469

341

37.3

Ext Income/(Expense)

-

-

-

PBT (incl. Ext Items)

144.2

125

220.2

469

341

(% of Sales)

23.5

22.4

30.8

24.3

19.2

Provision for Taxation

47

38

24.6

73

(36.1)

155

102

51.4

(% of PBT)

32.5

30.2

33.4

33.0

30.0

Minority Interest

0

0

0

Recurring PAT

97

87

12.0

147

(33.7)

314

239.1

31.3

PATM

15.9

15.6

20.6

16.3

13.5

Exceptional items

0

Reported PAT

97

87

12.0

147

(33.7)

314

239

31.3

Equity shares (cr)

3.2

3.2

3.2

3.2

3.2

FDEPS (`)

30.0

26.8

12.0

45.2

(33.7)

96.7

73.6

31.3

Source: Company, Angel Research

May 6, 2016

2

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

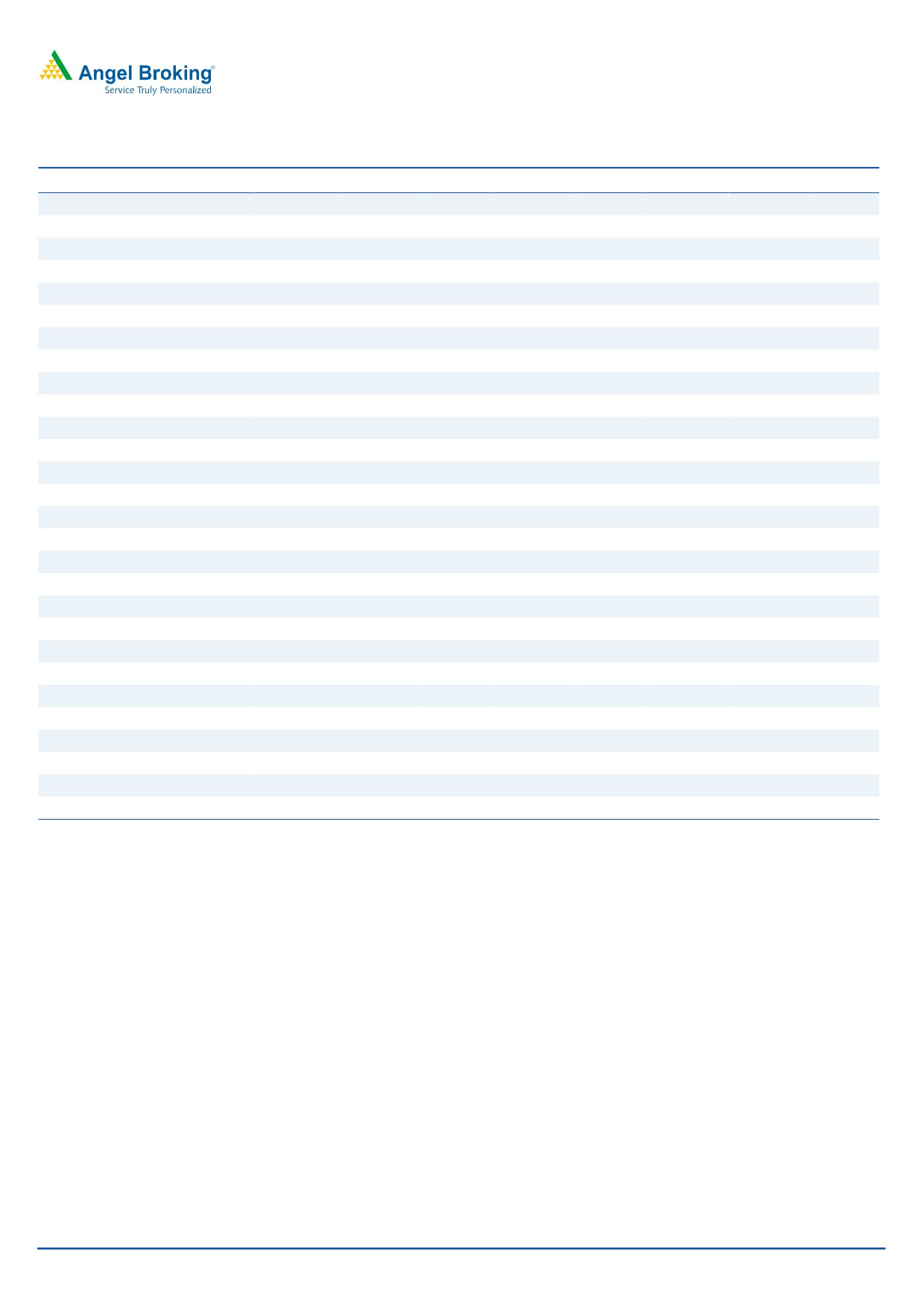

Healthy top-line growth

For 3QFY2016, the company’s top-line grew by ~11% yoy to ~`614cr (against

our estimate of ~`624cr), mainly due to growth in both female hygiene and health

care segment. Going forward we expect the company to continue to perform on

the top-line front due to strong brand positioning, market leadership and wide

distribution network.

Exhibit 2: Top-line growth trend

800

25

700

20

15

600

10

500

5

400

0

300

-5

200

-10

100

-15

0

-20

Net Sales

QoQ growth (%)

Source: Company, Angel Research

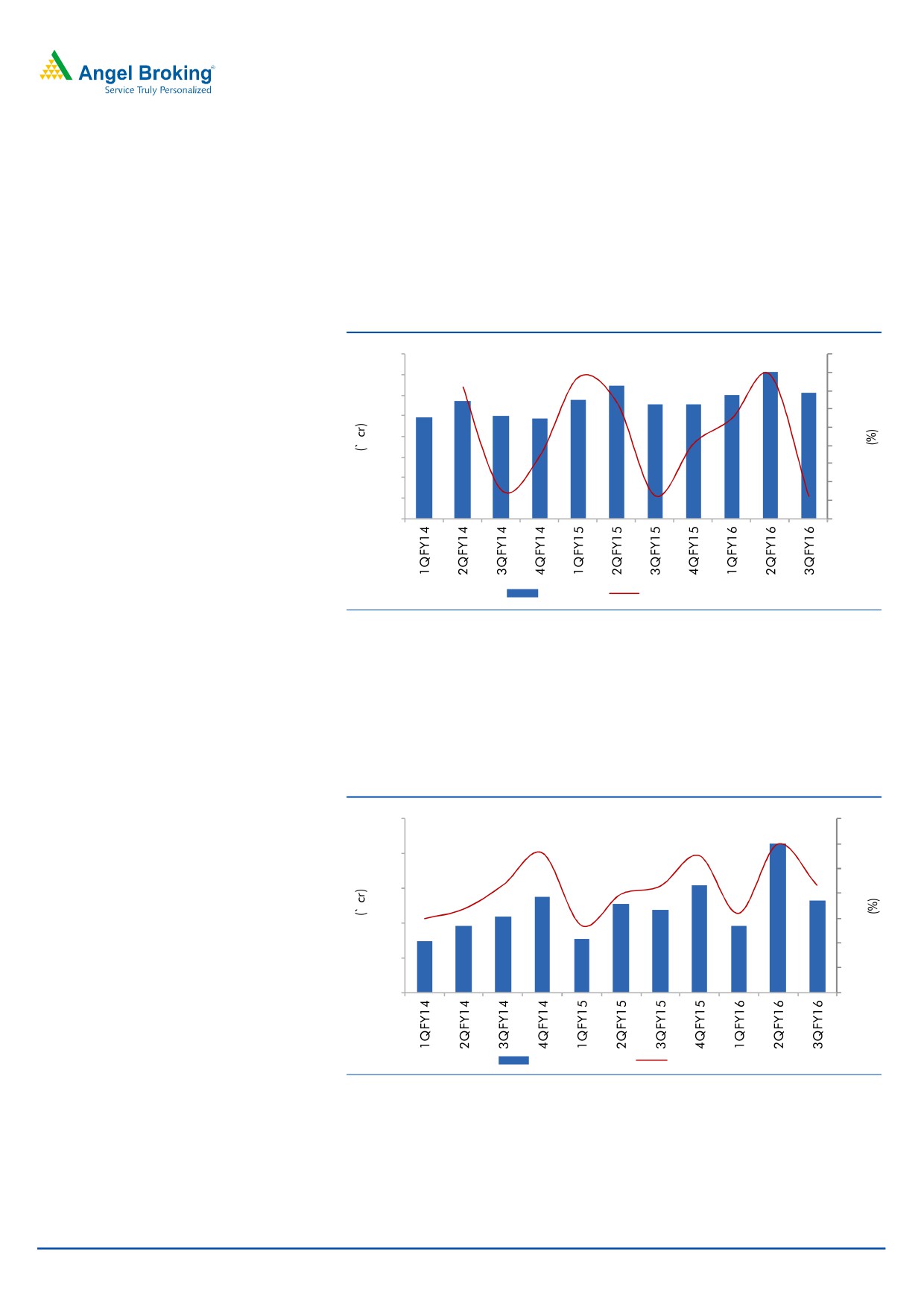

Operating margin contracts due to higher other expenses

On the operating profit front, the company reported growth of 8.5% yoy due to

healthy sales growth. However, the margin contracted by 41bp yoy to 21.7%,

primarily on account of higher other expenses.

Exhibit 3: Operating profit growth trend

250

35

30

200

25

150

20

15

100

10

50

5

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

May 6, 2016

3

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

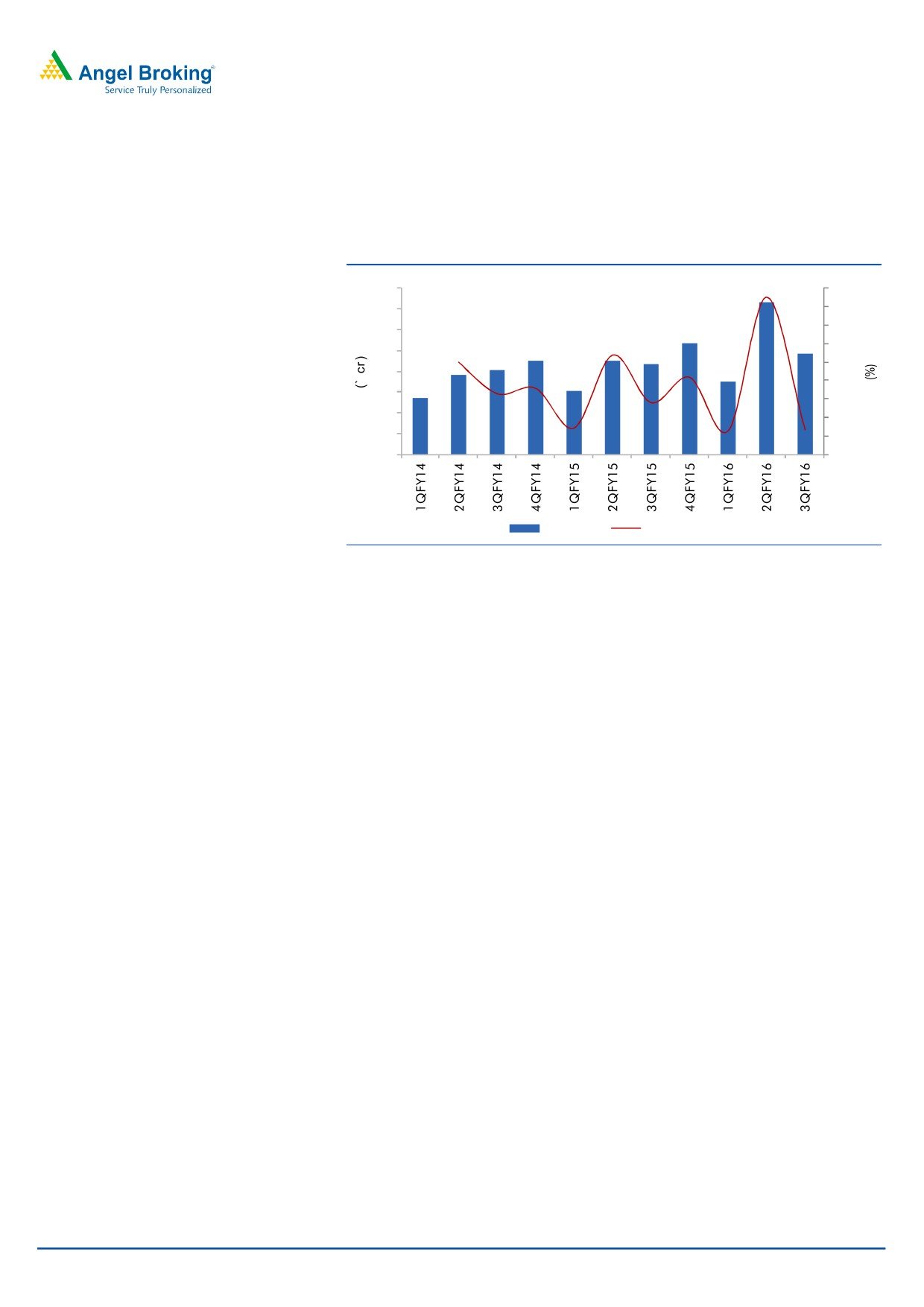

PAT grew ~12%

During the quarter, the company reported net profit growth of ~12% yoy to

~`97cr (our estimate was of ~`98cr) on account of healthy sales growth.

Exhibit 4: Net Profit and growth trend

160

120

140

100

80

120

60

100

40

80

20

60

0

40

-20

20

-40

0

-60

Net Profit

QOQ growth (%)

Source: Company, Angel Research

May 6, 2016

4

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Investment rationale

Lower penetration in female hygiene segment to drive growth

The current Indian female hygiene market size is of ~`3,400-3,600cr. Over the

last four years, this market has grown at a CAGR of ~30%. We expect the growth

momentum to continue on back of increase in penetration from the current 12%

levels, while it would likely be supported by the government’s campaign to

promote sanitary napkins among adolescent girls. In this space, two brands

capture more than 80% of the market share, with ‘Whisper’, a brand of P&G,

being the leader with a market share of ~47-50%, and the other being Stayfree

from Johnson & Johnson which has a market share of ~35-38%. In our view, P&G

is best placed to benefit from the opportunities arising on the back of rising

disposable incomes and increasing proportion of working women in the country

coupled with its widening distribution reach.

Lower custom duty on raw material to help margin expansion During the Union

Budget FY2016-17, the government has reduced the custom duty on pulp of

wood, a key raw material for P&G, from 5% to 2.5%; and on super absorbent

polymer (used in the manufacture of sanitary pads, napkins and tampons) from

7.5% to 5%. This will be positive for P&G with it having a major presence in female

personal care products.

Outlook and valuation

On the top-line front, we expect the company to report ~13% CAGR and on the

bottom-line front, we expect ~15% CAGR over FY2015-18E on the back of strong

brands and distribution network. Further, P&G is a market leader in both of its

product, ie Whisper (female hygiene segment) and Vicks (healthcare segment-

ointment, creams, cough drops etc). We are positive on the stock and recommend

a Buy rating with a target price of `7,369.

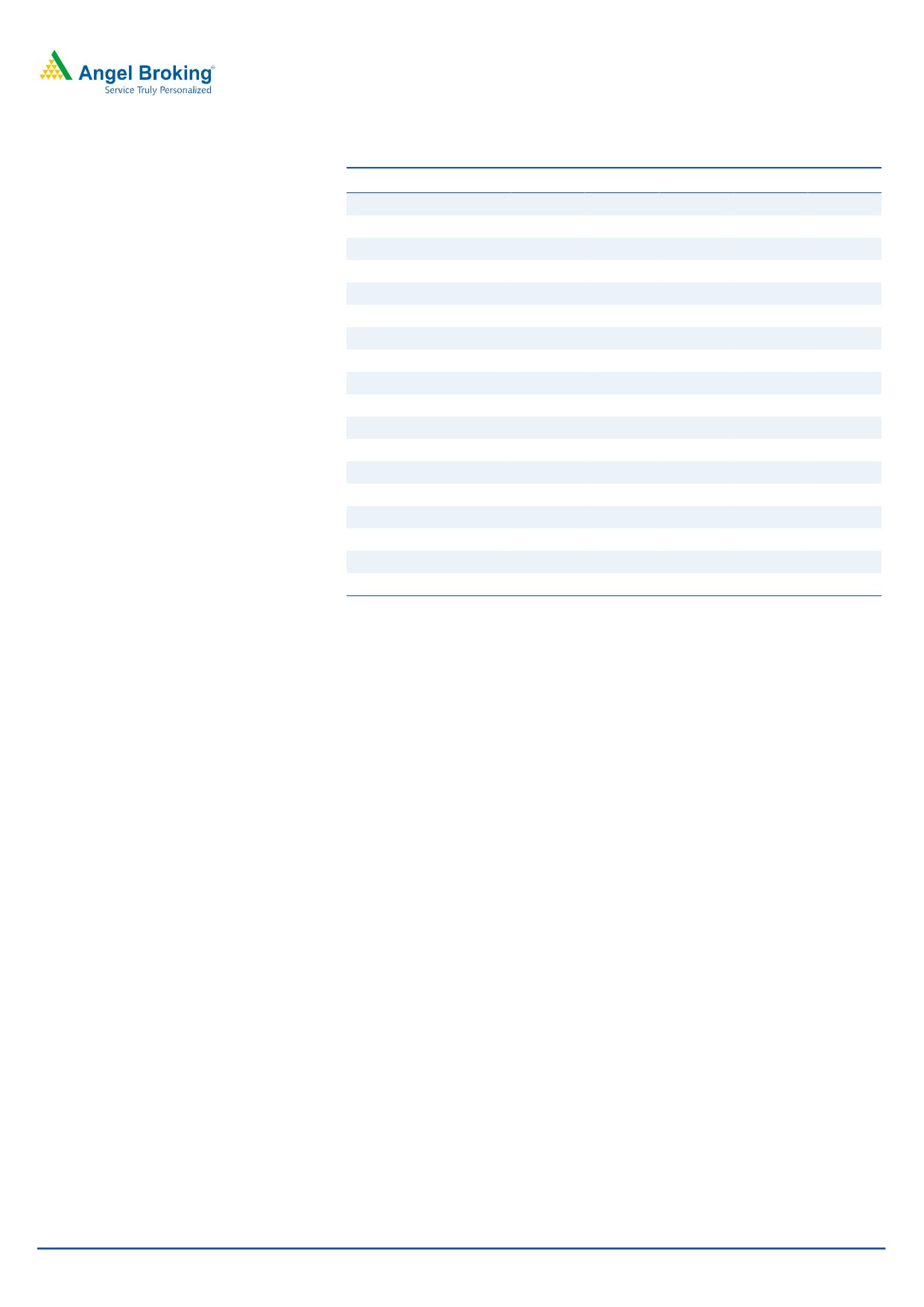

Exhibit 5: One year forward PE band

8 ,000

10.0 X

20.0 X

30.0 X

40.0 X

50.0 X

7 ,000

6 ,000

5 ,000

4 ,000

3 ,000

2 ,000

1 ,000

0

Source: Company, Angel Research

May 6, 2016

5

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Downside risks to our estimates

P&G has a concentration risk as its revenue is majorly dependent on just two

brands, which is Whisper and Vicks. Although these brands are market leaders in

their respective segments as of now, but any increase in competition could lead to

loss of revenue for the company.

Company Background

Procter & Gamble Hygiene and Health Care Ltd (P&G) is one of India's fastest

growing FMCG companies that has in its portfolio well recognized brands such as

Whisper (69% of revenue) and Vicks (31% of revenue). These brands come under

the company’s feminine care and health care divisions, respectively. The parent

company Procter & Gamble was incorporated on 20th July, 1964 in Mumbai; it

has four regional offices and one plant located at Kundaim in Goa. P&G Hygiene

and Health Care Ltd is a 71% owned subsidiary of Procter & Gamble and

manufactures, distributes and markets two segment leading products Whisper and

Vicks.

May 6, 2016

6

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Profit & Loss Statement

Y/E June ( ` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Total operating income

2,051

2,334

2,588

2,939

3,342

% chg

21.6

13.8

10.9

13.6

13.7

Total Expenditure

1,630

1,849

1,985

2,257

2,573

Raw Materials

813

921

983

1,120

1,283

Personnel Expenses

95

113

122

141

167

Selling & Administrative Expenses

398

444

466

520

575

Others Expenses

324

371

414

476

548

EBITDA

421

484

603

682

769

% chg

67.9

15.1

24.5

13.1

12.7

(% of Net Sales)

20.5

20.8

23.3

23.2

23.0

Depreciation& Amortisation

35

53

60

66

71

EBIT

386

432

543

616

697

% chg

75.8

12.0

25.6

13.5

13.2

(% of Net Sales)

18.8

18.5

21.0

21.0

20.9

Interest & other Charges

5

6

6

7

7

Other Income

80

75

76

78

80

(% of PBT)

17.4

14.9

12.4

11.3

10.4

Share in profit of Associates

-

-

-

-

-

Recurring PBT

460

501

613

688

770

% chg

60.8

8.8

22.3

12.2

12.0

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

PBT (reported)

460

501

613

688

770

Tax

158

155

190

213

239

(% of PBT)

34.4

30.9

31.0

31.0

31.0

PAT (reported)

302

346

423

474

532

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

0

0

0

0

0

PAT after MI (reported)

302

346

422

474

531

ADJ. PAT

302

346

422

474

531

% chg

48.7

14.6

22.1

12.2

12.0

(% of Net Sales)

14.7

14.8

16.3

16.1

15.9

Basic EPS (`)

93.0

106.6

130.2

146.2

163.7

Fully Diluted EPS (`)

93.0

106.6

130.2

146.2

163.7

% chg

48.6

14.6

22.1

12.2

12.0

May 6, 2016

7

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Balance Sheet

Y/E June (` cr)

FY2014

FY2015

FY2016E FY2017E FY2018E

SOURCES OF FUNDS

Equity Share Capital

32

32

32

32

32

Reserves& Surplus

970

1,196

1,501

1,842

2,225

Shareholders Funds

1,003

1,229

1,533

1,875

2,257

Total Loans

-

-

-

-

-

Deferred Tax Liability

11

14

14

14

14

Total Liabilities

1,014

1,243

1,548

1,889

2,272

APPLICATION OF FUNDS

Gross Block

428

524

574

624

674

Less: Acc. Depreciation

189

215

275

341

412

Net Block

240

309

298

283

261

Capital Work-in-Progress

98

39

39

39

39

Investments

-

-

-

-

-

Current Assets

1,163

1,596

2,026

2,479

2,990

Inventories

119

119

142

169

192

Sundry Debtors

86

114

135

161

192

Cash

269

619

1,102

1,355

1,603

Loans & Advances

539

506

388

441

535

Other Assets

151

239

259

353

468

Current liabilities

505

719

834

930

1,037

Net Current Assets

658

877

1,192

1,549

1,953

Deferred Tax Asset

18

18

18

18

18

Total Assets

1,014

1,243

1,548

1,889

2,272

May 6, 2016

8

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Cashflow Statement

Y/E June (` cr)

FY2014

FY2015

FY2016E FY2017E FY2018E

Profit before tax

460

501

613

688

770

Depreciation

35

53

60

66

71

Change in Working Capital

9

123

169

(104)

(156)

Interest / Dividend (Net)

(61)

(66)

(6)

(7)

(7)

Direct taxes paid

(111)

(206)

(190)

(213)

(239)

Others

3

21

-

-

-

Cash Flow from Operations

335

426

646

429

440

(Inc.)/ Dec. in Fixed Assets

(135)

28

(50)

(50)

(50)

(Inc.)/ Dec. in Investments

-

-

-

-

-

Cash Flow from Investing

(135)

28

(50)

(50)

(50)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(16)

(14)

-

-

-

Dividend Paid (Incl. Tax)

(81)

(89)

(118)

(133)

(149)

Interest / Dividend (Net)

(0)

(1)

6

7

7

Cash Flow from Financing

(97)

(104)

(112)

(126)

(142)

Inc./(Dec.) in Cash

103

350

484

253

248

Opening Cash balances

166

269

619

1,102

1,355

Closing Cash balances

269

619

1,102

1,355

1,603

May 6, 2016

9

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Key ratios

Y/E June

FY2014

FY2015E FY2016E FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

68.8

60.1

49.2

43.8

39.1

P/CEPS

61.6

52.1

43.0

38.5

34.5

P/BV

20.7

16.9

13.6

11.1

9.2

Dividend yield (%)

0.4

0.5

0.6

0.6

0.7

EV/Sales

10.0

8.6

7.6

6.6

5.7

EV/EBITDA

48.8

41.6

32.6

28.5

25.0

EV / Total Assets

13.5

10.3

8.3

6.9

5.8

Per Share Data (`)

EPS (Basic)

93.0

106.6

130.2

146.2

163.7

EPS (fully diluted)

93.0

106.6

130.2

146.2

163.7

Cash EPS

103.9

122.8

148.8

166.4

185.7

DPS

27.5

30.2

36.5

40.9

45.8

Book Value

309.0

378.5

472.3

577.5

695.4

Returns (%)

ROCE

38.4

35.2

35.4

32.9

30.9

Angel ROIC (Pre-tax)

52.5

70.8

126.0

118.6

106.6

ROE

30.1

28.1

27.6

25.3

23.5

Turnover ratios (x)

Asset Turnover (Gross Block)

4.8

4.5

4.5

4.7

5.0

Inventory / Sales (days)

21

19

20

21

21

Receivables (days)

15

18

19

20

21

Payables (days)

42

59

60

58

56

WC cycle (ex-cash) (days)

(6)

(23)

(21)

(17)

(14)

May 6, 2016

10

Procter & Gamble Hygiene & Health Care | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Procter & Gamble Hygiene & Health Care

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

May 6, 2016

11